Introduction

As with most developed countries, Australia’s insurance industry is robust and competitive. While considerable efforts are exerted to minimise risk, fortuitous events still occur, so insurance companies serve as a means to transfer risk. They invest the funds allocated for such and then use some of the proceeds to pay for claims when unforeseen events occur, provided that these are covered by the premiums.

Thus, the insurance industry is a key enabler for the government, businesses, and individuals to invest in infrastructure as well as in offering new products and services with confidence.

A lot of companies offer insurance policies in the Australian market. However, many of them are actually underwritten by a small number of insurers using various brand names. Coles, Woolworths, Australia Post, Myer, RACV, NRMA, among others, present themselves as insurance providers, but they only sell other companies’ insurance products under their brand names.

They’re not exposed to any insurance risks as a result, but they do receive a commission (around 10-20%) on the sale of such insurance products.

The companies that do actually provide insurance are sometimes referred to as underwriters, and some of them offer insurance products directly to the public. In Australia, four companies account for three-quarters of the general insurance market. These are Insurance Australia Group (IAG), Suncorp Group, QBE, and Allianz, and they cover 29%, 27%, 10%, and 8% of the market, respectively.

On the whole, insurance can be divided into roughly three components:

General insurance.

This is broadly classified into a further two categories: liability insurance and property insurance.

Liability insurance.

These include Compulsory Third Party (CTP) motor insurance, worker’s compensation, professional indemnity insurance, public/products liability insurance, directors and officers liability and fraud/crime insurance. Some, particularly the CTP and worker’s compensation are mandatory under the law, but they don’t particularly vary from state to state.

Property insurance.

These generally cover natural perils and accidental losses, and include home and contents insurance, industrial special risks, travel insurance, aviation, agriculture, construction and comprehensive insurance for motor vehicles.

Health insurance.

Medicare is the Australian Government’s basic universal health insurance, and it is partly funded by a 2% levy sourced from most taxpayers.

While just about any Australian citizen can avail of this, middle to high income earners are encouraged to seek out private health insurance, as are those who want coverage for services that aren’t eligible under Medicare.

Life insurance.

Initially, life insurance companies were mutual companies, but many of them were demutualised in the 1980’s and 1990’s. Until recently, the majority were owned by banks as well. The market for life insurance in Australia is estimated to be worth AUD44 billion.

Three of the bestselling life insurance products sold in Australia are life insurance, disability income insurance, and

superannuation investment products. Also, unlike in many other countries, Australian insurers offer a lump sum total and permanent disability insurance rather than payment received in installments.

Challenges Within the Industry

While 2018 and 2019 were mostly banner years for the industry, there are concerns about a handful of challenges looming ahead.

A Potential Recession

Halfway through 2019, the insurance industry’s profit went down by 12%, a significant reduction from the previous two years’ annual results. Unfavorable claims, primarily from natural hazards and lower reserve releases, allegedly contributed to this decline.

The ongoing disputes between the United States and China over tariffs and trade rules, as well as the diminishing of the economic stimulus from federal tax cuts and additional government spending by 2020 along with rising interest rates could possibly discourage consumer borrowing, housing construction, and business expansion.

The Covid-19 Pandemic

For general insurers, the pandemic has brought about a 10-20% drop in policy renewals and a 20-30% drop in the acquisition of new customers. Life insurers, on the other hand, face challenges on several fronts, and commercial insurers must contend with extensive business interruptions within the industries and sectors that they service.

Remote Staff as a Possible Solution

Aside from pivoting to adjust to the #NewNormal, insurers must also look to maintaining their growth momentum and recalibrating their long-term plans to meet the evolving demands of the emerging digital economy. Improving operational efficiency, boosting productivity, and lowering costs with new technology and talent transformations are all good strategies to begin with, and Remote Staff can provide people to help insurers accomplish all of that via the following roles available in its talent pool:

Roles

- Remote Sales Representative/Life Insurance Agent

- Underwriting Assistant

- Subrogation Consultant

- Data Collection Specialist

Tasks Per Role That Can Be Outsourced

Remote Sales Representative/Life Insurance Agent

- establish new accounts through prospecting, leads and networking;

- maintain client relationships;

- field customer inquiries;

- connect customers to the right products;

- call and schedule appointments;

- submit weekly activity and result reports;

- service existing accounts.

Underwriting Assistant

- log new business and renewal submissions;

- assist underwriters with quotes, binders, and policy issuance workflows;

- review submission materials and policies, ensuring that they are complete and accurate;

- follow up with brokers for outstanding underwriting information and respond to endorsement requests;

- maintain account files in accordance with company policy and compliance guidelines;

- assist underwriters in evaluating risks and determining if certain exposures fall within the scope of company underwriting guidelines.

Remote/Waco-Quality Assurance Specialist for Insurance

- complete daily reports;

- review insurance applications and make corrections if necessary;

- communicate and coordinate with parties involved;

- update existing records;

- access various databases and the internet for research.

Subrogation Consultant

- manage caseloads;

- negotiate settlements within broad limits of assigned authority;

- identify, prepare and refer files suitable for inter-company arbitration or suit;

- determine and complete appropriate levels of investigation to assess liability;

- determine damages for highly complex claims;

- provide recommendations for settlement and disposition of claims exceeding authority levels;

- documents all relevant activity on assigned files and make appropriate recommendations for each one as needed;

- coach and train less experienced subrogation representatives or trainees.

Data Collection Specialist

- make weekly calls per prospect record;

- utilize database to mark responses and activities in telemarketing campaigns and generate follow-up activities for appropriate salespeople;

- collect pertinent prospect information, such as correct billing addresses and contact information, along with the number of insured dependents;

- prepare weekly reports.

AU Insurance Companies That Have Successfully Outsourced Remote Work Roles to the Philippines

Company: Unique Building Services

Role: Data Entry Specialist

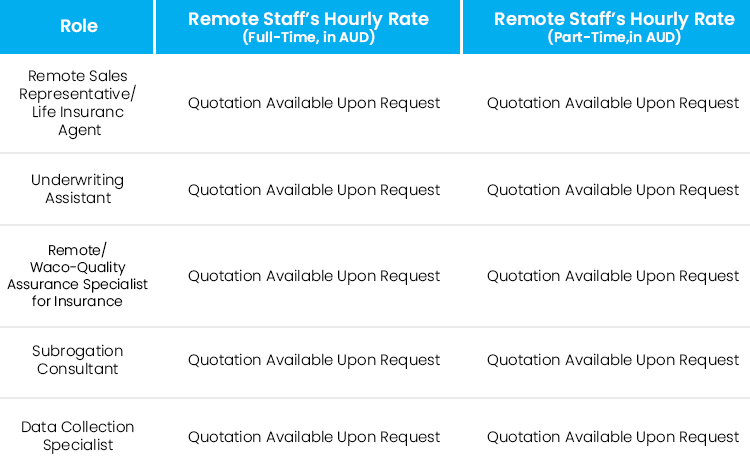

Remote Staff’s Hourly Rates

As some of the roles in the previous sections are highly specialized, their rates aren’t standardized yet. Furthermore, unless stated otherwise, the rates indicated below are expressed in Australian dollars (AUD):

- Stock & Consumption control

- Utility, Uniforms, Fuel, Cash Expenses per Project, Logistics etc.

AU Logistics Companies That Have Successfully Outsourced Remote Work Roles to the Philippines

Companies:

Companies:

- DXT

- Palmers Relocations

- Sherpa AU

Remote Work Roles:

- Back Office Administrator

- Full Time – Data Entry

- Phone Support Professional ( Project – Office Based)

- Phone Support Professional (Home-based)

- Phone Support Professional (Office Based)

- Phone Support Professional (Project – Office Based)

- Phone Support Specialist

- Team Assistant Manager (Office-Based)

- Team Leader – Back Office Administrator

- Team Manager (Office Based)

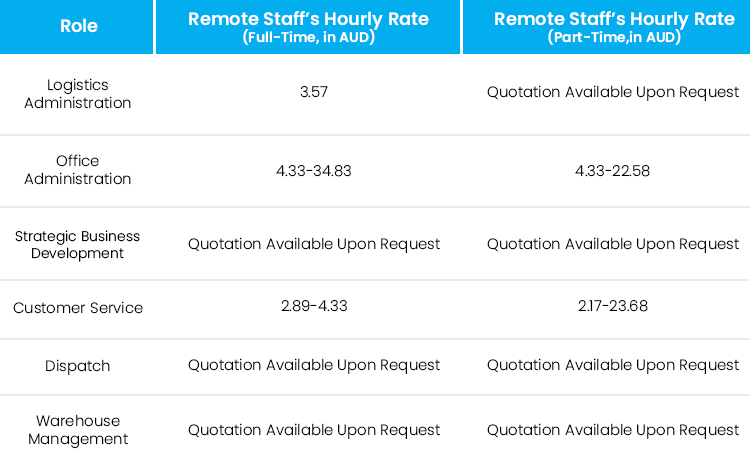

Remote Staff’s Hourly Rates

As some of the roles in the previous sections are highly specialized, their rates aren’t standardized yet. Furthermore, unless stated otherwise, the rates indicated below are expressed in Australian dollars (AUD):

Companies:

Companies: